News Analysis: Capgemini Immediate Delivers Cloud Services To Royal Mail Group

![]()

Capgemini Changes The Rules Of The Cloud Game

On July 27, 2010, Capgemini announced a six-year cloud computing deal with Royal Mail Group (RMG). The partnership brings the capabilities of Capgemini’s Infostructure Transformation Services (ITS) and Capgemini Immediate to RMG. As the UK's second largest employer, RMG employs 188,000 people, handles over 80 million items per day, and delivers over 150,000 parcels per day via ParcelForce, its worldwide express parcel business. Analysis of the deal reveals two key points:

- Royal Mail Group chooses cloud computing for concrete business value. RMG sought a new eBusiness platform. Through the RFP process, RMG determined that traditional on-premise software and hardware solutions on single stack technologies (e.g. Microsoft, Oracle, and IBM) did not meet current and future business requirements. Requirements included decreasing the time to market to deliver new solution offerings, delivering pay-as-you-go services to meet the needs of the organization's personal and small or medium business customers, and supporting RMG's innovative parcel delivery services to keep up with the UK's online shopping boom. After careful analysis, RMG realized they would have to go best of breed.

Point of View (POV): With over 3000 web pages and 100 applications, RMG felt the dual weight of transforming legacy applications and the need to free up resources for innovation. As with many legacy systems, changes to their current eBusiness platform most likely took too long to implement and the integration challenges of managing a specialized and aging e-business environment became too cumbersome to manage. RMG chose Capgemini Immediate because the solution delivered an ecosystem of solutions as one offering with Capgemini acting as both the services integrator and prime contractor. RMG gained both the business value in best of breed solutions and the flexibility of the cloud computing model.

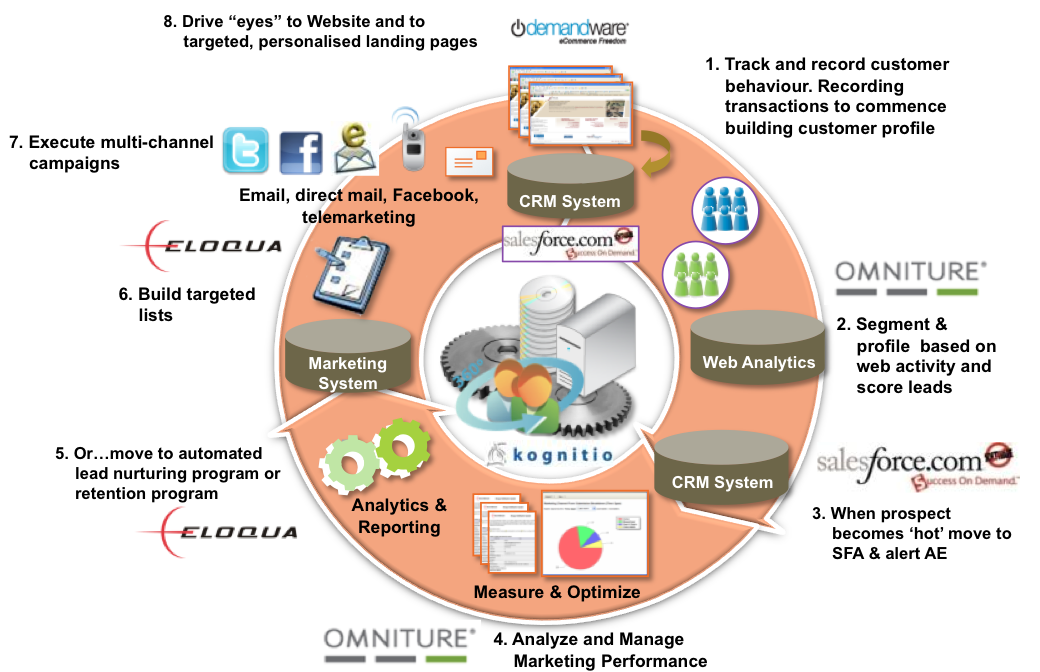

- Capgemini Immediate mitigates the challenges of managing SaaS best of breed "hell". Capgemini's integrated best of breed cloud offering includes 18 initial SaaS and open source suppliers across the software-as-a-service (SaaS) and platform-as-a-service (PaaS) layers of cloud computing. Key examples of core PaaS components delivered immediately to the customer include Drupal (Content Management), Apache Software Foundation (Common UI service), IBM Infosphere Datastage (ETL), Cordys (Business process orchestration), Attenda (Business activity management), and Talis (Semantic data management). For example, the marketing and eBusiness SaaS offering includes Salesforce.com (Customer transactions), Demandware (eCommerce), Kognitio (Data Warehousing-as-a-Service), Ominiture (Web analytics), Eloqua (Online marketing) and Google (Search) see (Figure 1).

POV: Leading companies who seek best of breed approaches often face challenges in integration and managing multiple vendor contracts. The Capgemini Immediate offering reduces the risk of best of breed because clients sign one contract and Capgemini manages the delivery risk, SaaS and hybrid integration, and the management of partners. In addition, the on-demand pricing and delivery model enables organizations to manage seasonal peaks such as holidays that may require excess capacity. Best of breed solutions can link back to the RMG ecosystem with ease allowing for more choices among application solutions.

Source: Capgemini

The Bottom Line For Buyers (Users) - Best of Breed Integrated SaaS/PaaS Offerings Deliver Innovation While Bypassing Legacy Apps Environments

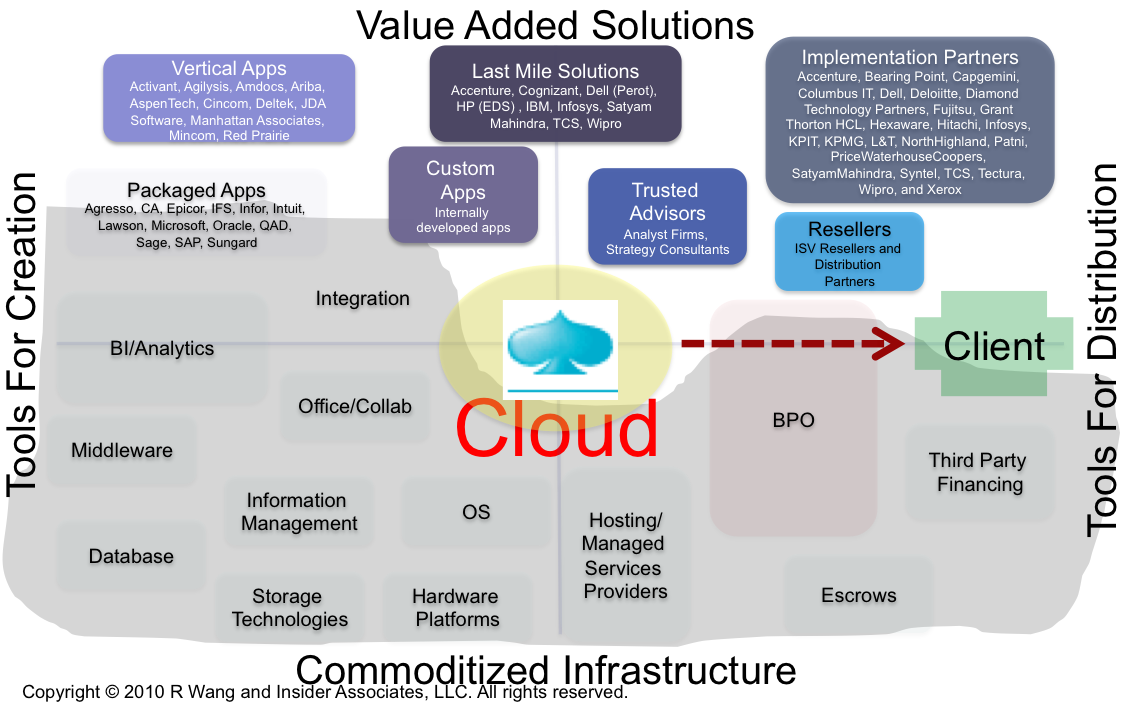

RMG did not choose cloud because it was the latest fad. Instead, the Capgemini Immediate solution provided a collection of best of breed solutions that met RMG's key business requirements. Should Capgemini succeed in delivering Scenario 7: Legacy Replacement in the 10 SaaS/Cloud Strategies For Legacy Apps Environments, RMG will gain (see Figure 2):

- Flexibility and scalability. RMG can expand or contract services as demand levels change.enhanced flexibility and scalability, enabling specific services to expand or contract rapidly as levels of demand change

- Capex reduction. RMG no longer has to procure extra hardware and applications every time the change platforms. This reduces major capital outlay.

- Improved integration. The Capgemini Immediate platform allows third party services to easily integrate back into the solution offering.

While Cloud/SaaS adoption has moved beyond the tipping point, organizations should not rush in without an adequate apps strategy. Start by taking into consideration the following criteria in planning an overall apps strategy:

- Expected business value and outcomes for a project

- Business processes required to support business value and outcomes

- Organizational design required to sustain change

- Technology and solutions to support efforts

- Deployment options such as on-premises, SaaS, BPO, and other services

Figure 2. Capgemini Immediate Addresses Scenario 7: Legacy Long Term Replacement

The Bottom Line For Sellers (Vendors) - Expect More Solution Providers To Blur The Lines With Differentiated IP

Solution providers and partners will invest in value added solutions over commoditized infrastructure. The continued commoditization of technology results in richer and more relevant Cloud stacks. As a result, a handful of larger players will emerge to drive down the costs of computing while encouraging ecosystems to deliver value added solutions. Buyers can expect packaged apps, vertical apps, last mile solutions, and implementation partners, to invest in specialized and higher value intellectual property (IP). Capgemini Immediate is an example where service providers build differentiated intellectual property (IP) using the Cloud.

Service providers should go on the SaaS/Cloud offensive if they want to deliver rapid innovation to customers and break the cycle of dependence on packaged apps vendors. Service providers can take market share through SaaS by investing in white spaces in the solution road map with verticals and other pivot points that have not been well served. In addition, expect forms of SaaS BPO to emerge as clients seek best of breed SaaS and hybrid deployments.

Your POV.

Have you already made the transition? Ready to share your best practices? Buyers, do you need help with your Cloud and SaaS strategy? Looking to make the transition to Cloud and SaaS? Let us put the expertise of over 1000 software contract negotiations to work for you. Please post or send on to rwang0 at gmail dot com or r at softwaresinsider dot org and we’ll keep your anonymity.

Please let us know if you need help with your next gen apps strategy, overall apps strategy, and contract negotiations projects. Here’s how we can help:

- Designing a next gen apps strategy

- Providing contract negotiations and software licensing support

- Demystifying software licensing

- Assessing SaaS and cloud

- Evaluating Cloud integration strategies

- Assisting with legacy ERP migration

- Planning upgrades and migration

- Performing vendor selection

- Renegotiating maintenance

Resources And Related Research:

20100810 A Software Insider's POV - R "Ray" Wang - "Tuesday’s Tip: 10 SaaS/Cloud Strategies For Legacy Apps Environments"

20100809 A Software Insider's POV - R "Ray" Wang - "Research Report: The Upcoming Battle For The Largest Share Of The Tech Budget (Part 2) – Cloud Computing"

20100621 A Software Insider's POV - R "Ray" Wang - "Research Report: How SaaS Adoption Trends Show New Shifts In Technology Purchasing Power"

20100322 A Software Insider’s POV – R “Ray” Wang -”Understanding The Many Flavors Of Cloud Computing/SaaS”

20091222 A Software Insider’s POV – R “Ray” Wang “Tuesday’s Tip: 10 Cloud And SaaS Apps Strategies For 2010″

20091208 A Software Insider’s POV – R “Ray” Wang – “Tuesday’s Tip: 2010 Apps Strategies Should Start With Business Value”

20091012 A Software Insider’s POV – R “Ray” Wang – “Research Report: Customer Bill of Rights – Software-as-a Service”

20090714 Sandhill.com – R “Ray” Wang – “Opinion: Moving to a SaaS Offensive”

20090602 A Software Insider’s POV – R “Ray” Wang ” Tuesday’s Tip: Now’s The Time To Consider SaaS Software Escrows”

20081028 A Software Insider’s POV – R “Ray” Wang “Tuesday’s Tip: SaaS Integration Advice”

Reprints

Reprints can be purchased through the Software Insider brand or Altimeter Group. To request official reprints in PDF format, please contact r@softwareinsider.org.

Disclosure

Although we work closely with many mega software vendors, we want you to trust us. Capgemini is a project client with Altimeter and not a client of Insider Associates, LLC. Capgemini is neither a retained client of Altimeter group nor a retained client of Insider Associates, LLC. For the full disclosure policy please refer here.

Copyright © 2010 R Wang and Insider Associates, LLC. All rights reserved.

R "Ray" Wang

R "Ray" Wang R "Ray" Wang

R "Ray" Wang