Quarterly Financial Tracker: Q3 CY 2010 Enterprise Software Vendors Solidify Performance Turnaround

The super majority (26 of 27) of publicly traded software vendors in the Software Insider Index® delivered turnaround stories for Q3 Cy 2010 year-over-year (YoY) performance. SaaS vendors and middleware vendors led the charge with solid double digit gains against tough comps. Performance of on-premises apps vendors reflected the easy comps from a dismal 2009 downturn. An analysis of the 2010 CY Q2 2010 results show:

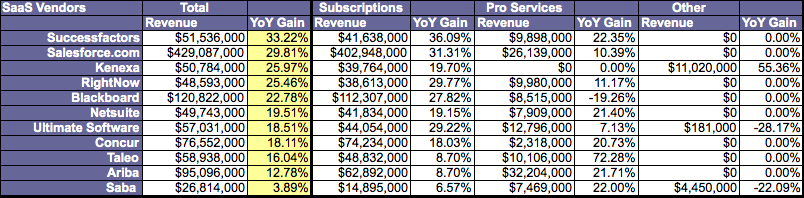

SaaS Vendors Continue To Crush All Expectations In Subscriber Growth (Figure 1.)

- SaaS vendors showed massive gains in subscription revenue at on-premises vendor expense. SuccessFactors (33.22%) continued the lead in quarterly revenue gains followed by a record breaking Salesforce.com quarter (29.81%). Kenexa (25.97%) and RightNow (25.46%) also demonstrated above 25% YoY quarterly gains.

- Subscription license growth has become the norm for both SaaS and On-Premises vendors looking at SaaS revenue.

- On premises vendors w/ subscriptions showed traction. SAP reported $101M of subscription revenue and JDA software reported $5.758M in subscription revenues.

- Of note, Saba (3.89%) and Kenexa (25.97%) were added to the Software Insider Index® this quarter

Figure 1. SaaS Vendors Continue To Crush All Expectations In Subscriber Growth (Right click to view full image)

Copyright © 2010 R Wang and Insider Associates, LLC. All rights reserved.

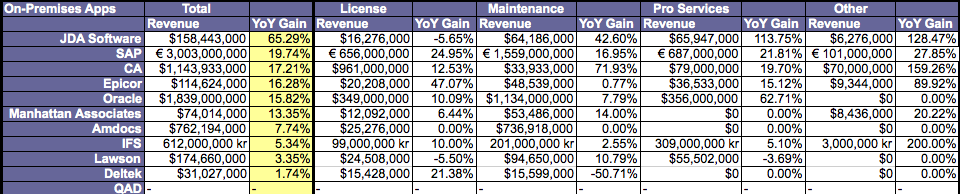

Traditionally On Premises Apps Vendors Fare Well As Technology Spending Picks Up

- JDA Software (65.29%) continues to benefit from retail and supply chain vendor consolidation. However, JDA's growth came from maintenance revenue, not new license gains. In fact, the ratio of maintenance to license revenues remains dangerously high at 3.94. The good news - focused efforts around SaaS options also grew. Meanwhile, rival Manhattan Associates saw gains with (13.35%) YoY quarterly growth with respectable new license gains.

- SAP (19.74%) showed a huge turnaround with significant gains. However, new license growth came mostly from analytics revenues and not from core apps such as ERP, CRM, SCM.

- Traditional bellwethers CA (17.21%) and Oracle (15.82%) showed above 15%, healthy YoY quarterly gains.

- SMB vendors showed mixed results with Epicor (16.28%) leading the pack through gains in Epicor 9 and significant new license growth of 47.07%. Epicor and Microsoft Dynamics (not listed) have been beneficiaries of the two-tier apps strategy movement. On the other hand, IFS (5.34%), Lawson (3.35%), and Deltek (1.74%) barely moved the needle in revenues. Deltek's 21.38% new license growth reflected a structural shift in the business as new license gains make up maintenance losses.

- Four vendors continue to enter dangerous trends with maintenance to license revenue ratios above 3: Manhattan (4.42), JDA (3.94) Lawson (3.86), Oracle (3.24)

Figure 2. On Premises Apps Vendors Fare Well As Technology Spending Picks Up (Right click to view full image)

Copyright © 2010 R Wang and Insider Associates, LLC. All rights reserved.

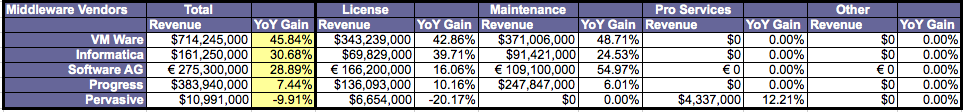

Middleware Vendors Benefit From Optimization Mandates (Figure 3.)

- VMware (45.84%), Informatica (30.68%), and Software AG (28.89%) crush numbers as demand for middleware, virtualization, and integration continue to gain traction.

- All middleware vendors maintain healthy maintenance to license revenue ratios below 2.0: SoftwareAG (.65), VMware (1.08), Informatica (1.31), Progress (1.82).

Figure 3. Middleware Vendors Benefit From Optimization Mandates

- (Right click to view full image) Copyright © 2010 R Wang and Insider Associates, LLC. All rights reserved.

- The Bottom Line - Enterprise Software Is Back

- Designing a next gen apps strategy

- Providing contract negotiations and software licensing support

- Demystifying software licensing

- Assessing SaaS and cloud

- Evaluating Cloud integration strategies

- Assisting with legacy ERP migration

- Planning upgrades and migration

- Performing vendor selection

- Renegotiating maintenance

Refresh cycles, demanding business requirements, and shift to hybrid deployment options fuel growth for this quarter. Organizations continue to free up budget to support legacy apps optimization to fund innovation projects. SaaS will be the predominant entry point for new innovation while organizations seek two-tier approaches to consolidate legacy apps. The theme for enterprise software customers remains "Show us the business value!"

Are you increasing your spending on enterprise software? Want to know more about a specific vendor's financial health? Can we help you work with a specific vendor? Please post or send on to rwang0 at gmail dot com or r at softwareinsider dot org and we’ll keep your anonymity. Further, let us know if you need help with your next gen apps strategy, overall apps strategy, and contract negotiations projects. Here’s how we can help:

Disclaimers* Not responsible for any math errors or erroneous revenue information.

1. Calendar year estimates based on the quarter nearest the calendar year.

2. Why these vendors than others? Easy – because I cover them.

3. Exchange rates as of February 25th, 2010 for vendors who have not published quarterly conversions. Not responsible for currency flux.

4. Estimates created for privately held vendors, when listed.

Not sure? Please read the quarterly filings yourself =)

Related resources and links

2010 Calendar Year Q2

2010 Calendar Year Q1

Software Insider Index™ (SII): 2009 SII Top 35 Enterprise Business Apps Vendors™

2009 Calendar Year Q4

2009 Calendar Year Q3

2009 Calendar Year Q2

2009 Calendar Year Q1

Software Insider Index™ (SII): 2008Software Insider IndexTM (SII): SII Top 30 Enterprise Business Apps VendorsTM & SII Top SaaS Business Apps VendorsTM SII Top 30 Enterprise Business Apps Vendors™

2008 Calendar Year Q4

2008 Calendar Year Q3

2008 Calendar Year Q2

2008 Calendar Year Q1

Reprints

Reprints can be purchased through the Software Insider brand or Constellation Research, Inc. To request official reprints in PDF format, please contact r@softwareinsider.org.

Disclosure

Although we work closely with many mega software vendors, we want you to trust us. A full disclosure listing will be provided soon on the Constellation Research site.

Copyright © 2010 R Wang and Insider Associates, LLC. All rights reserved.

R "Ray" Wang

R "Ray" Wang R "Ray" Wang

R "Ray" Wang